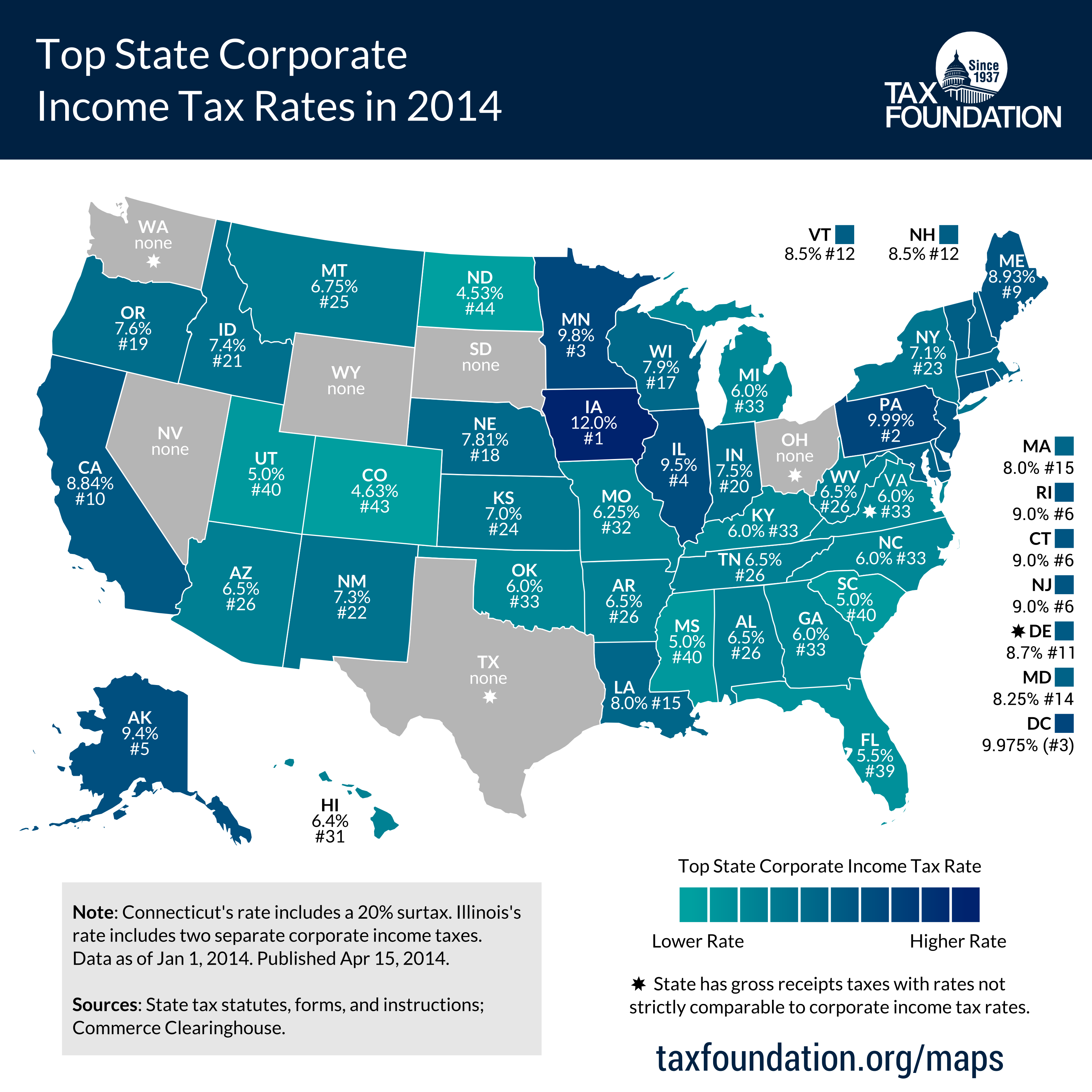

b&o tax states

Washingtons BO tax is calculated on gross income from activities. It is measured on the value of products gross proceeds of sale or gross income of the business.

Washington State Sales Use And B O Tax Workshop

A Washington State superior court granted summary judgment for banking associations holding that the states additional 12 business and occupation BO tax imposed on certain financial institutions violates the Commerce Clause of the US.

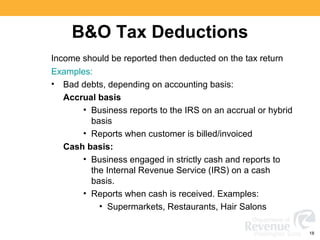

. BO also does not consider income or loss offers no deduction for cost of. When a Court Misses the Mark. Washington State BO tax is based on the gross income from business activities.

Most Washington businesses fall under the 15 gross receipts tax rate. Washington unlike many other states does not have an income tax. Manufacturing BO Tax or Wholesaling or Retailing BO Tax.

Additional BO tax imposed on financial institutions. Washington BO Tax Classifications. Washington state doesnt have income tax like most states but business owners do need to pay Business and Occupation BO tax and this is usually on a state and city level.

The state BO tax is a gross receipts tax. It is taxed at 0 percent on manufacturing gross production. The BO tax for labor materials taxes or other costs of doing business.

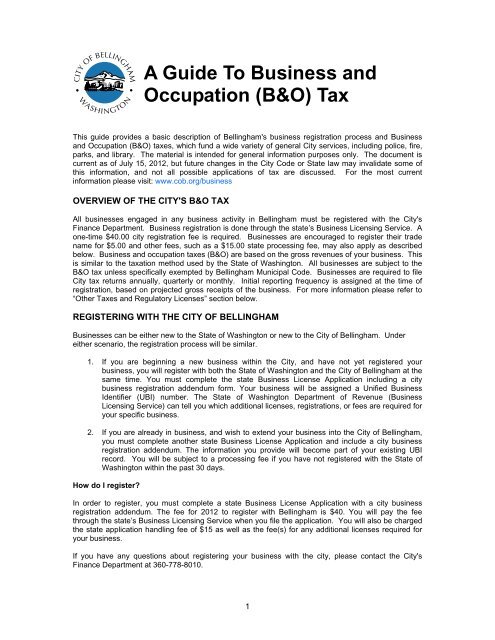

Legislation adopted in the 2003 session required the 45 cities with local BO taxes to adopt a city BO tax model ordinance. It is measured on the value of products gross proceeds of sale or gross income of the business. The Washington State BO tax is a gross receipts tax.

Washington legislators had gone back to the drawing board after. This includes the value of products gross proceeds of sale or the gross income of the business. Unlike the retail sales tax a sale does not have to occur for a business to owe BO tax.

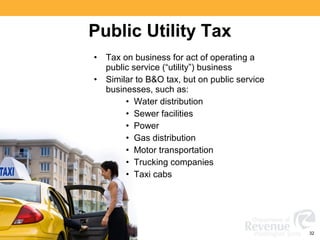

A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by steamboat or steamship and motor carriers. Business and Occupation Tax. If a city is not listed they have not reported to AWC that they have a local BO tax.

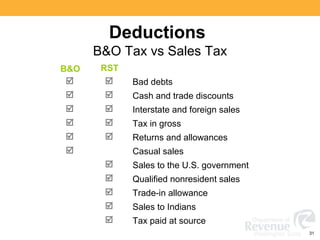

The BO offers very few deductions and those allowable are often within narrowly defined industry sectors. Read the high courts decision PDF 562 KB. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts.

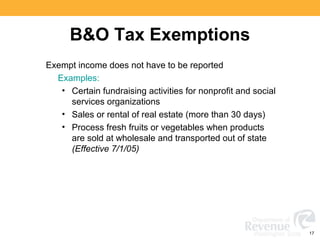

Washingtons BO tax is calculated on the gross income from activities. However your business may qualify for certain exemptions deductions or credits. 253 591-5252 by contacting the Tacoma.

10 2020 Washington Gov. The Washington State Supreme Court today September 30 2021 upheld the constitutionality of the states business and occupation BO tax surcharge imposed on certain financial institutions. When paying the B O tax to the Department of Revenue you declare your income in different categories.

Heres what the BO tax looks like for your business. Businesses pay a Washington BO tax rate depending on their classification. The Washington BO tax is a gross receipts tax applied on property and services sourced to Washington most comparable to the Ohio or Oregon Corporate Activity Tax CAT.

City of Tacoma Tax License Division 747 Market St Rm 212 Tacoma WA 98402. Local business occupation BO tax rates Effective January 1 2022 City Phone Manufacturing rate Retail rate Services rate Wholesale rate Threshold Tax rates are provided for cities with general local BO taxes as of the date listed. The State of Washington can levy heavy penalties such as the 50 evasion penalty and having a qualified tax attorney can make a big difference.

The state BO tax is a gross receipts tax. Washington Bankers Association v. Census BureauIn the state with the highest tax burden New York an average.

Constitution because it discriminates against out-of. Washington unlike many other states does not have an income tax. Consider a median-income household which earns around 69000 according to the US.

The tax amount is based on the value of the manufactured products or by-products. Jay Inslee signed Senate Bill 6492 repealing the BO tax surcharges on certain service-based gross receipts and advanced computing businesses enacted through House Bill 2158 the 2019 Workforce Education Investment Act in favor of a simplified regime. The Washington State Business and Occupation tax BO tax is measured on a companys gross receipts.

For example if you extract or manufacture goods for your own use you owe BO tax. Those who make or sell products in Washington will face two BO taxes. It is measured on the value of products gross proceeds of sale or gross income of the business.

BO Tax State Taxes Follow. The model was updated in 2007 2012 and 2019EHB 2005 passed in 2017 also established a task force of city and business representatives to recommend changes to the two-factor apportionment formula for service income under RCW. When you submitted your gross receipts you received a check for 50000.

Whether youre older and looking for the best states to retire in or younger and looking to start a family in a more affordable state taxes matter. Best States With the Lowest Overall Tax Burden. Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates ranging from 0138 percent to 15 percent.

The Washington Supreme Court recently reviewed the much-maligned additional Business Occupation. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. B O tax rates.

However you may be entitled to the. Even if you have a business and have not been paying B O Taxes do not wait for the Department of Revenue to discover this. Blank Rome LLP on 10222021.

Washington unlike many other states does not have an income tax. This means there are no deductions from the BO tax for labor materials taxes or other costs of doing. This means you pay taxes on the total amount of revenue you pull in for your business whether you make a profit or not.

State Supreme Court Upholds B O Tax On Large Banks In Washington Mynorthwest Com

Washington State Sales Use And B O Tax Workshop

Washington State Sales Use And B O Tax Workshop

A Guide To Business And Occupation Tax City Of Bellingham Wa

Top State Corporate Income Tax Rates In 2014 Tax Foundation

Excise Tax Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

Retail Combo Businesses How To Make Your Annual Report To The Wa Dor For Excise Taxes Seattle Business Apothecary Resource Center For Self Employed Women

Business And Occupation B O Tax Washington State And City Of Bellingham

Wa Business Occupation Tax Return Tumwater Fill Out Tax Template Online Us Legal Forms

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

Washington State Sales Use And B O Tax Workshop

Washington State Sales Use And B O Tax Workshop

Am I Taxed Too Much Understanding The Impacts Of Fiscal Policy Washington State Wire

Importance Of State And Local Tax Planning Various Types Of Taxes Levied On Business Review Table 1 1 Various Business Transactions Subject To Taxation Ppt Download

B Amp O Tax City Of Bellingham

Record Wa Dor Excise And Sales Tax Payment In Quickbooks Online Gentle Frog Bookkeeping And Custom Training